A win-win program that increases employee benefits while reducing both your cost and risk.

A win-win program that increases employee benefits while reducing both your cost and risk.

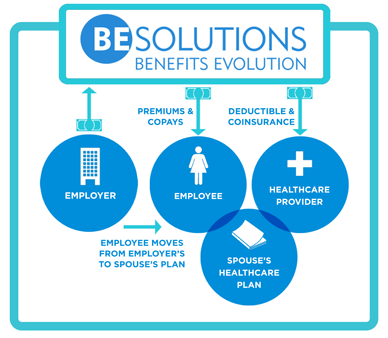

Maintaining cost control of your health benefits program can be one of the most challenging functions as a business owner or benefits specialist. Let us help you take the uncertainty out of your benefits offering with the unique Spousal Coverage Medical Expense Reimbursement Plan (MERP). The whole idea behind MERP is to move your eligible employees off of your benefits plan and onto his or hers spouse’s plan. As the facilitator of this change, your business self-funds the spouse’s premium contribution and out-of-pocket costs. You’re actually increasing your employee’s take home pay and providing a richer benefits program.

The program is called the Spousal Coverage Medical Expense Reimbursement Plan or Spousal Coverage MERP. The MERP is designed to move employees from your health plan to their spouse’s health plan and provide their family with better coverage. The Spousal MERP offers two reimbursement benefits:

Premium Reimbursements can be structured using several methods. The Spousal MERP can reimburse any amount over a certain dollar amount. In this approach, we would encourage you to choose an amount that will afford savings to the participant based on the cost for your plan.

Premium Reimbursements can be structured using several methods. The Spousal MERP can reimburse any amount over a certain dollar amount. In this approach, we would encourage you to choose an amount that will afford savings to the participant based on the cost for your plan.

For example, if your plan costs $200 per month for a family contribution, we can set up the Spousal MERP to reimburse everything over $150 per month charged by the spouse’s plan. This insures that the spouse’s plan will cost no more than $150 per month in monthly contributions. A $50 per month savings will provide an incentive to enroll in this plan.

Another common choice for premiums is to have the plan cover the first dollar up to a certain monthly limit. This could be structured as follows: The Spousal MERP will reimburse up to $250 each month towards the cost of your spouse’s contributions for family medical coverage. In this case, those employees whose spouse’s contribution is $250 or less will pay nothing each month. Those with contributions higher than $250 can determine whether it makes sense to enroll based on the final cost.

BE Solutions’ personnel will meet with each eligible participant and/or their spouse, individually to assist in determining whether this program will benefit their family.

Again, there is flexibility here as far as setting up the benefits. The most common and what we typically recommend is 100% coverage for these items. The plan can be designed so that the Spousal MERP will reimburse 100% of all in network deductibles, copays and coinsurance expenses from utilizing the spouse’s health plan.

Since the spouse’s health plan will have an annual out of pocket maximum, there is an inherent limit for these expenses set by each plan. As an option, you could build in your own limit as well. For example, the Spousal MERP will reimburse 100% of all deductibles, copays and coinsurance expenses that a participant incurs from utilizing the spouse’s health plan up to $3,000 per calendar or plan year.

The reason we recommend not having too strict a limit is simple. The Spousal MERP program is a “Claims Avoidance” strategy. If an employee or dependent has high utilization costs on another plan, we are avoiding those claims on our client’s plan. If the out of pocket reimbursement does not cover enough costs, the employee may choose to enroll in our plan once again running the risk of those claims returning. We benefit most when employees with high claims choose to stay on the other plan.

There are three main groups that tend to enroll in the Spousal MERP. Each group has their own risk characteristics that make them ideal for our plan. Again, they are ideal in that they receive a benefit increase and you realize savings and risk reduction.

Many of these couples are looking to start a family. In most cases, they will max out their annual out of pocket costs for the wife as she goes through the pregnancy and birth process. Afterwards, the baby’s early years will result in utilization costs that we can reimburse at 100%.

You benefit because the risk of a premature birth or problem pregnancy are completely avoided. In addition, all pregnancy, birthing and well-baby costs will be covered by the spouse’s plan.

The wife/mother member of this group is keenly aware of the out of pocket costs associated with family health coverage. This makes her ideal in evaluating the plan benefits for her family. Females drive utilization for families. Females will see the benefit in getting 100% reimbursements for out-of-pocket costs.

You benefit because members move off the plan in blocks of three and above. You avoid the many office visits of the children, the pregnancies as the family grows and the future claims as the couple ages.

This may be our best group to move. As you know, the majority of our health claims are generated as we get older. You avoid quite a few medical claims and a lot of Rx claims when we move the older couples from the plan. They very much appreciate the reimbursements, particularly Rx copays that begin to add up each month as maintenance drugs become part of their daily regimen.

In short, we see Family Rates for our Spousal MERP plan of approximately $441.00 per month or $5,292.00 per year. Employee/Spouse Rates run even less than family rates.